Stop Guessing: How to Get Real-Time MRR Data on Any SaaS Company (Legally)

Every SaaS founder has been there. You're researching competitors, validating market opportunities, or trying to understand what's actually working in your space. You need real data—not vanity metrics or press release numbers, but actual Monthly Recurring Revenue, churn rates, and growth trajectories.

Instead, you're stuck with educated guesses, outdated funding announcements, and surface-level metrics that tell you nothing about real business performance. Meanwhile, your competitors who have access to real-time performance data are making strategic decisions with actual intelligence while you're flying blind.

The founders building the next generation of successful SaaS companies aren't relying on guesswork. They have systematic ways to track real-time MRR data across thousands of companies, identify which business models are actually working, and spot market opportunities before they become obvious to everyone else.

Here's how they're doing it—and how you can too.

Why Traditional SaaS Research Falls Short

The Funding Announcement Trap

Most founders rely on funding announcements and press releases to gauge competitor performance. But funding rounds tell you almost nothing about actual business metrics. A company that just raised $50M might be growing fast or burning cash trying to find product-market fit. Without real performance data, you're making critical business decisions based on PR spin.

The most successful founders understand that funding is a lagging indicator. By the time a company announces a big round, the market opportunity that drove their growth might already be saturated. You need real-time performance data to spot opportunities while they're still emerging.

The Vanity Metrics Problem

Public metrics like website traffic, social media followers, or press mentions don't correlate with business success. A company might have millions of page views but terrible conversion rates. Another might have modest web traffic but incredible unit economics and customer retention.

The metrics that actually matter—MRR growth, customer acquisition costs, churn rates, and lifetime value—are rarely shared publicly. Without access to this data, you're optimizing for the wrong things and missing the signals that indicate real business health.

The Scale of Manual Research

Even if you could manually research every competitor, the SaaS landscape is too dynamic for individual company analysis. New companies launch daily, existing companies pivot their business models, and market conditions change rapidly. By the time you finish researching one market segment, the competitive landscape has already shifted.

You need systematic ways to track performance across thousands of companies simultaneously. This isn't about having perfect information on every company—it's about having enough reliable data to spot patterns, identify opportunities, and make informed strategic decisions.

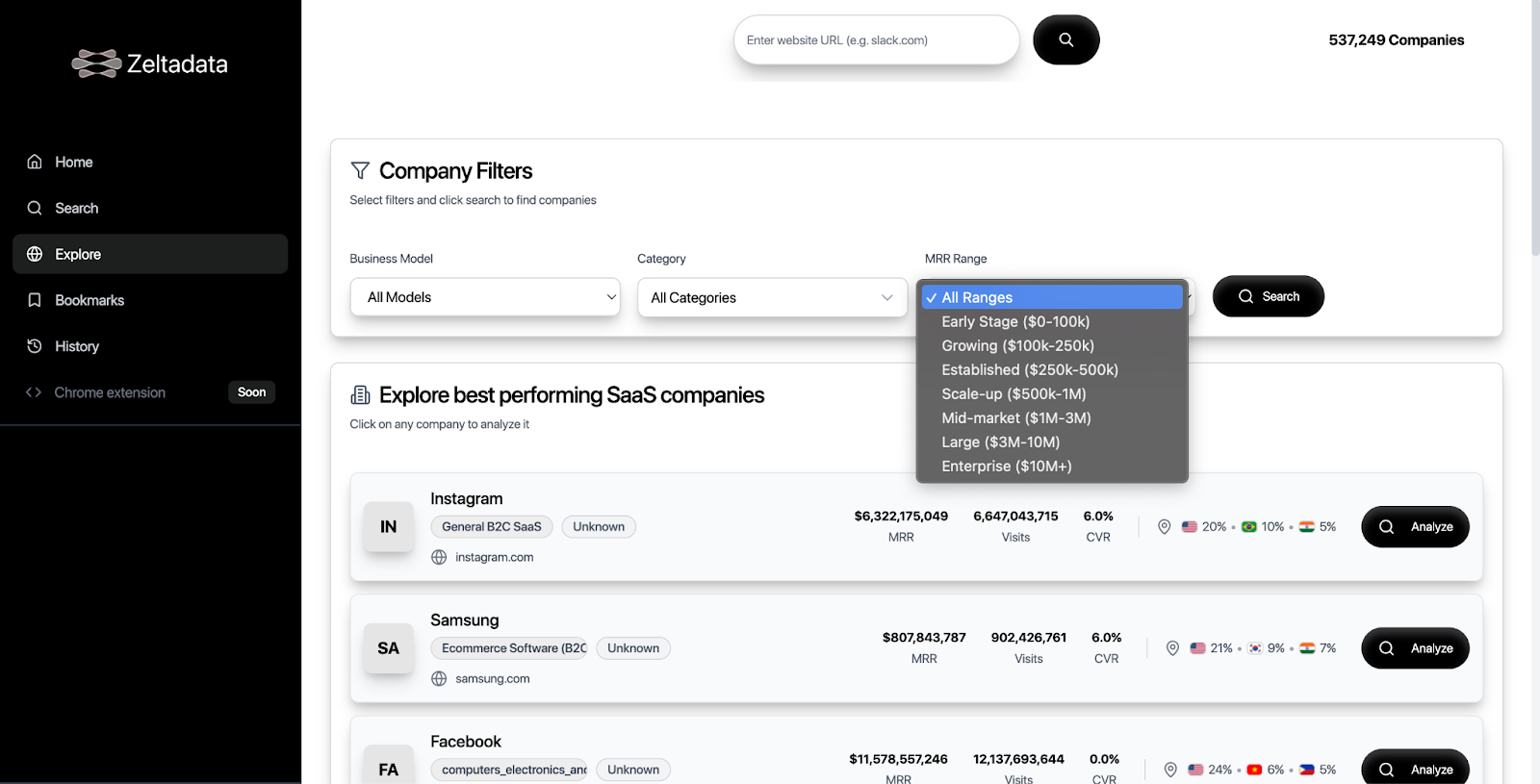

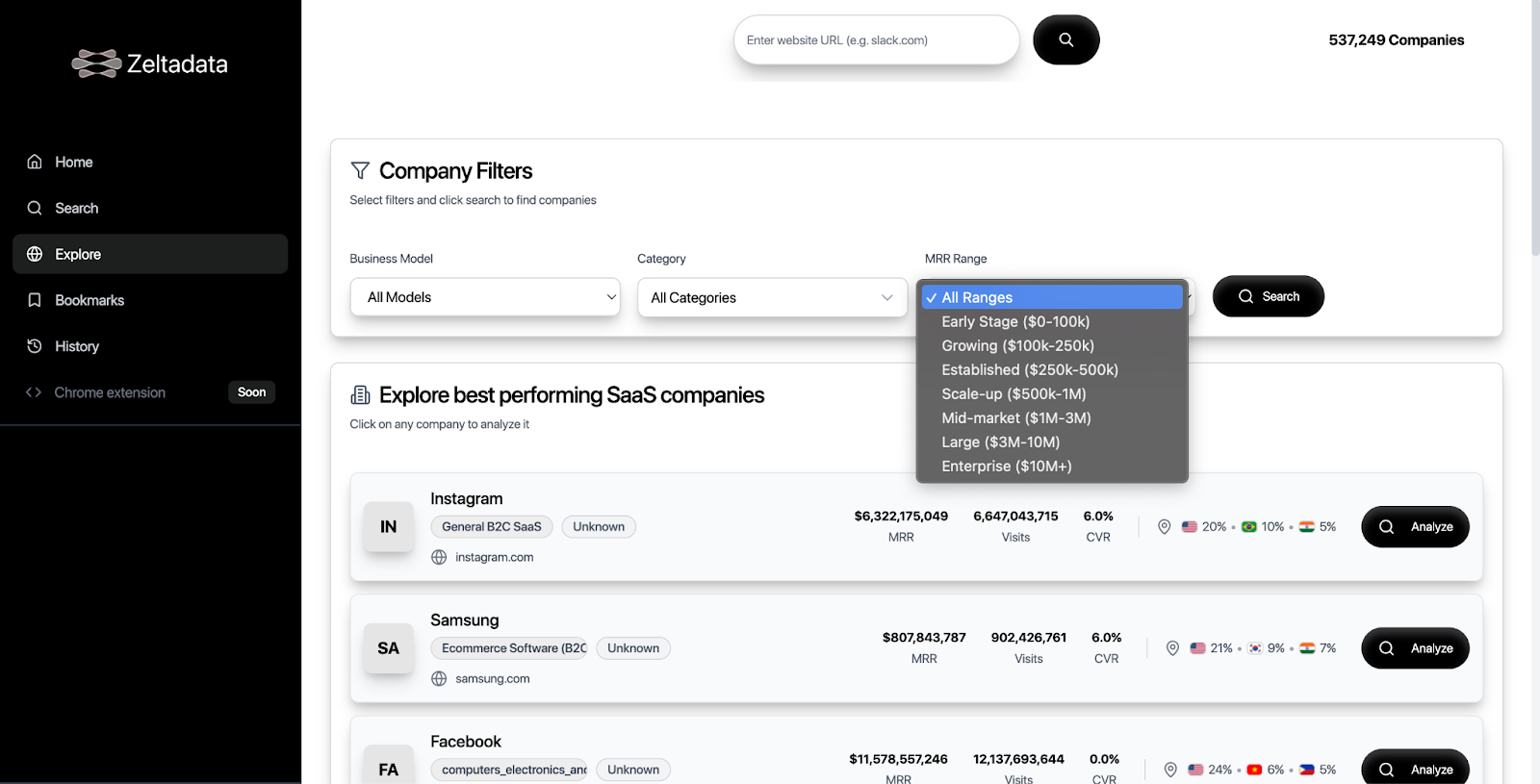

The Zeltadata Approach: Real-Time SaaS Intelligence

This is exactly why we built Zeltadata. As serial SaaS founders ourselves, we were frustrated by the lack of real-time, actionable data for competitive intelligence and market research. We were spending weeks manually researching markets, tracking competitors, and trying to identify trends—all while the best opportunities were slipping away to faster-moving competitors.

Traditional tools like Similarweb focus on web traffic, Crunchbase tracks funding rounds, and most other platforms provide surface-level metrics that don't correlate with business performance. What we needed was a system that could track actual business metrics—MRR, ARR, churn rates, and growth trajectories—across thousands of SaaS companies in real-time.

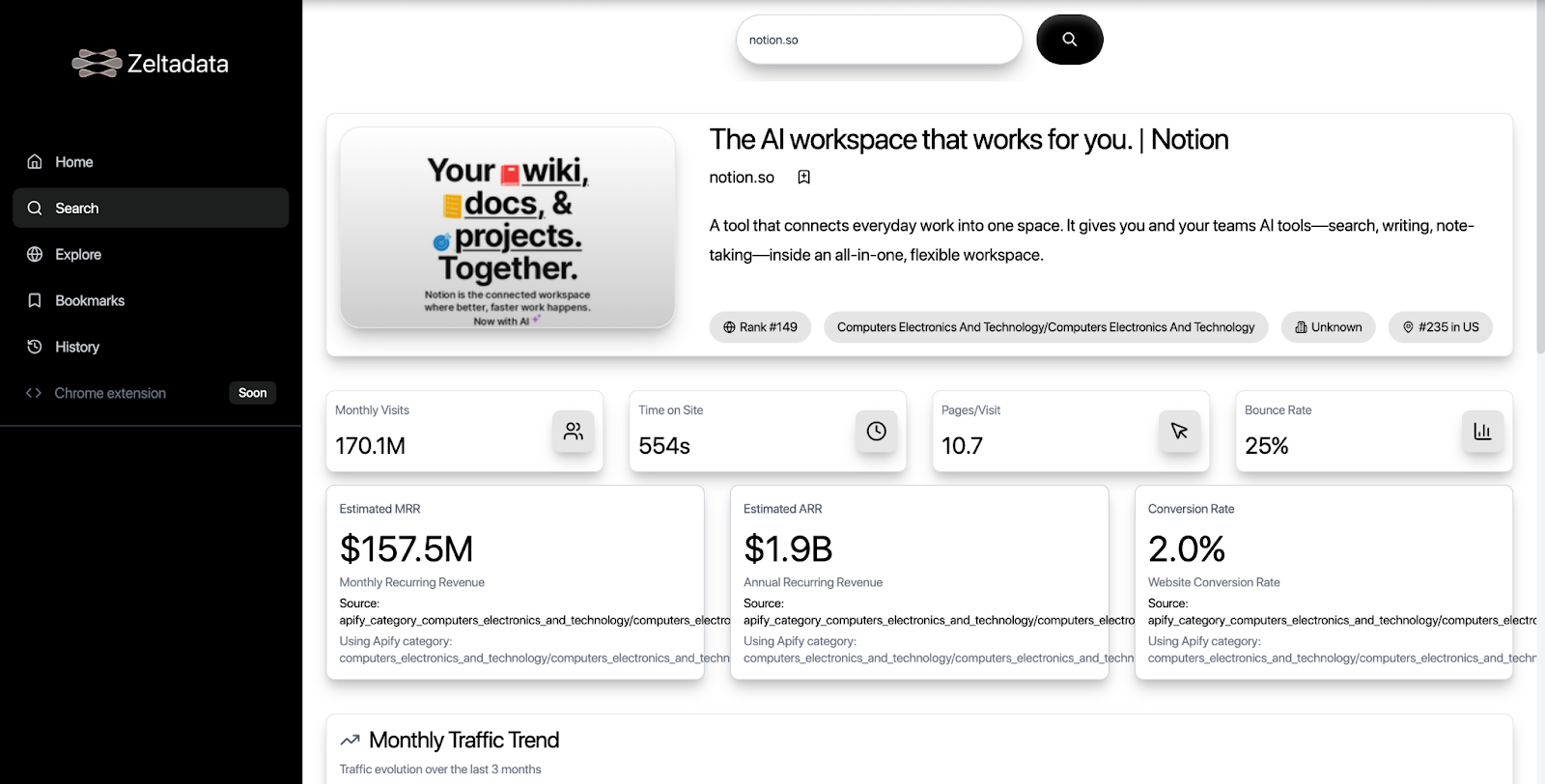

How Zeltadata Aggregates Real-Time MRR Data

Zeltadata doesn't rely on self-reported metrics or estimated data. Our platform aggregates performance data from multiple sources to provide accurate, real-time insights into SaaS company performance. Here's how it works:

Integration Data Analysis: We track integration patterns, payment processor connections, and third-party tool usage to understand company scale and growth patterns. Companies with rapid integration expansion typically correlate with strong MRR growth.

Performance Signal Aggregation: Our system monitors multiple performance indicators—hiring patterns, customer support volume, feature release frequency, and infrastructure scaling—to create comprehensive performance profiles.

Category-Based Benchmarking: Instead of analyzing companies in isolation, we benchmark performance within specific categories. This reveals which business models are working, which market segments are growing, and which companies are outperforming their peers.

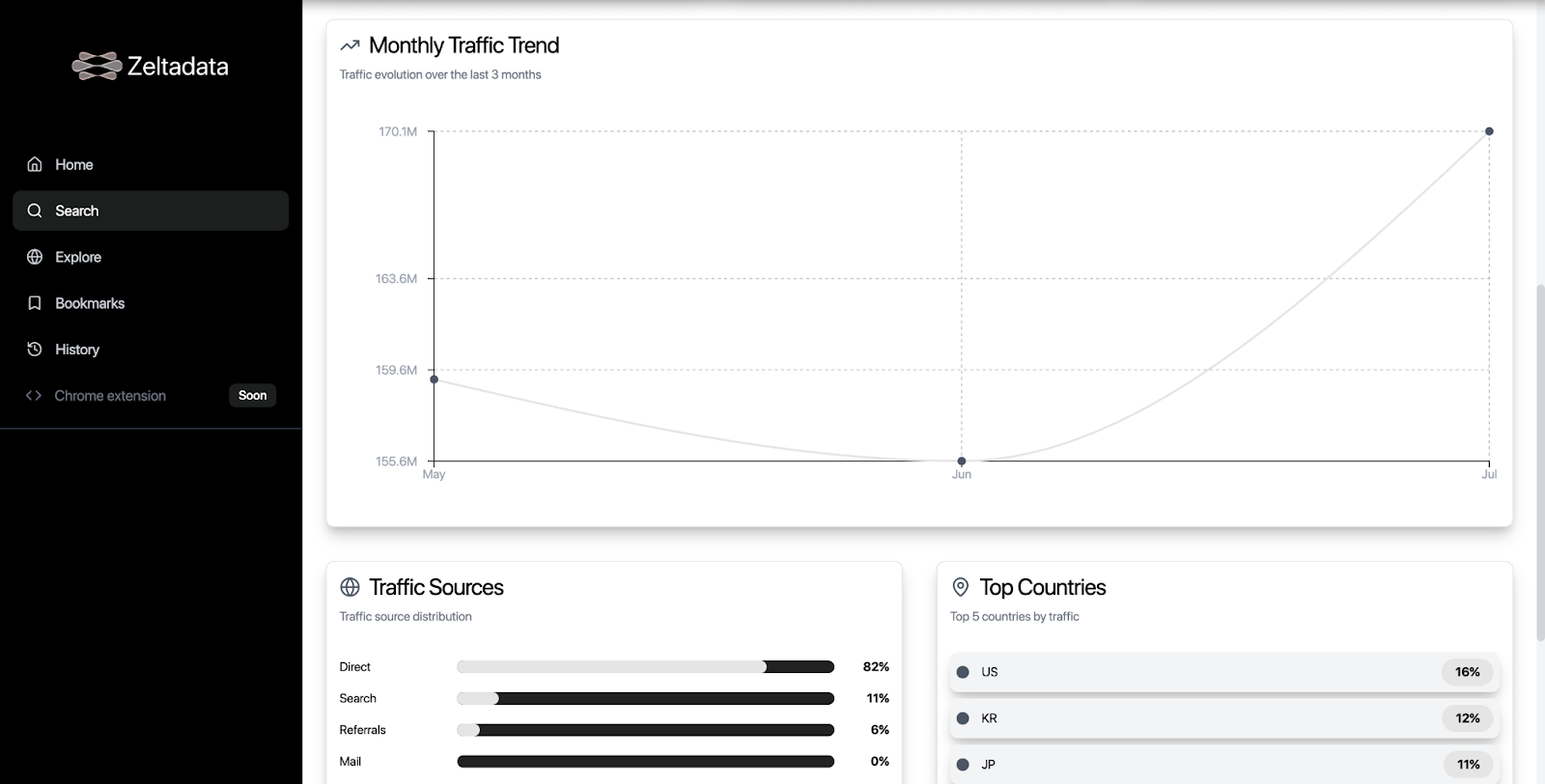

Real-Time Updates: Our data refreshes continuously, not quarterly or annually. This means you see performance changes as they happen, not months after the fact.

The Category Intelligence Advantage

What makes Zeltadata unique is our category-based approach to SaaS intelligence. Instead of searching for individual companies one by one, you can explore entire categories to identify patterns and opportunities.

Want to understand the legal SaaS market? You can see which companies are growing fastest, what their average MRR looks like, and how the category is evolving. Interested in AI tools for marketing? You can track performance across hundreds of companies to identify winners and spot emerging trends.

This category intelligence reveals opportunities that individual company research would never uncover. You start seeing market gaps, underserved segments, and emerging trends that create the foundation for strategic decisions.

What Real-Time MRR Data Reveals

Business Model Validation

Real-time MRR data tells you which business models are actually working in specific markets. You can see which companies are growing through enterprise sales versus product-led growth, which pricing strategies are driving retention, and which customer segments are most valuable.

This validation is crucial for founders making strategic decisions about their own business models. Instead of guessing what might work, you can see what is working for similar companies in your space.

Market Timing Intelligence

MRR growth patterns reveal market timing opportunities that other metrics miss. You can identify which categories are experiencing growth spikes, which are stagnating, and which are about to fragment into new subcategories.

This timing intelligence helps you enter markets at the right moment—early enough to capture first-mover advantages but not so early that you're creating demand from scratch.

Competitive Positioning Insights

Real-time performance data shows you which competitors are actually threats and which are just noise. A company with flat MRR growth isn't a competitive threat regardless of their marketing budget. A company with 20% monthly MRR growth deserves serious attention even if they're not well-known.

This positioning insight helps you focus competitive intelligence efforts on companies that actually matter and identify acquisition opportunities or partnership possibilities.

Customer Acquisition Strategy Analysis

MRR growth patterns combined with hiring data and marketing spend indicators reveal which customer acquisition strategies are working. You can identify companies that are scaling efficiently versus those that are buying growth unsustainably.

This analysis helps you optimize your own customer acquisition approach based on what's actually working for successful companies in your space.

The Competitive Intelligence Playbook

Market Entry Strategy

When entering a new market, most founders start with surface-level competitor analysis. With real-time MRR data, you can identify which companies are actually growing, what their business models look like, and where the gaps in their solutions create opportunities.

This intelligence helps you position your product effectively and avoid competing directly with companies that have strong momentum and healthy unit economics.

Product Development Priorities

Real-time performance data shows you which features and business model innovations are driving growth for successful companies. You can identify which product directions are worth investing in and which are likely to be dead ends.

This product intelligence helps you allocate development resources more effectively and avoid building features that don't correlate with business success.

Pricing Strategy Optimization

MRR data combined with company size and customer indicators reveals pricing strategies that work in specific market segments. You can see which companies are succeeding with freemium models, which are winning with enterprise pricing, and which are capturing mid-market effectively.

This pricing intelligence helps you optimize your own pricing strategy based on what's actually working for similar companies.

Partnership and M&A Opportunities

Real-time performance data helps you identify partnership opportunities and potential acquisition targets. Companies with strong MRR growth but limited market presence might be ideal partners. Companies with declining performance might be acquisition opportunities.

This strategic intelligence helps you build partnerships and consider M&A opportunities based on actual business performance rather than marketing positioning.

Category-Specific Intelligence Strategies

B2B SaaS Performance Patterns

Different SaaS categories have distinct performance patterns. Marketing automation tools typically show seasonal MRR fluctuations. HR software often has strong Q4 performance. Understanding these patterns helps you benchmark your own performance and identify opportunities.

AI SaaS Growth Trajectories

AI SaaS companies often show different growth patterns than traditional SaaS. They may have faster initial growth but higher churn rates as the technology matures. Understanding these patterns helps you set realistic expectations and identify sustainable AI business models.

Vertical SaaS Opportunities

Industry-specific SaaS solutions often have different performance characteristics than horizontal tools. They may have smaller total addressable markets but higher average revenue per user and better retention rates. Real-time data helps you identify which verticals are underserved and which are becoming saturated.

Building Your Competitive Intelligence System

Daily Monitoring Routines

The most successful founders don't just do competitive research once—they monitor their markets continuously. This means setting up systematic processes to track competitor performance, identify new entrants, and spot emerging trends.

With Zeltadata, you can create custom monitoring dashboards that track the companies and categories most relevant to your business. You get alerts when competitors show significant performance changes, when new companies enter your space, and when market conditions shift.

Weekly Analysis Sessions

Successful competitive intelligence requires regular analysis sessions where you review performance data, identify patterns, and adjust your strategy accordingly. This isn't about copying competitors—it's about understanding market dynamics and positioning your company effectively.

Monthly Strategic Reviews

Real-time data enables monthly strategic reviews where you can assess market positioning, evaluate competitive threats, and identify new opportunities. This regular rhythm of strategic thinking helps you stay ahead of market changes and make proactive decisions.

Quarterly Market Assessments

Every quarter, use real-time performance data to conduct comprehensive market assessments. Identify which categories are growing, which business models are working, and which opportunities are emerging. This quarterly discipline helps you make strategic decisions based on actual market conditions rather than assumptions.

The Data-Driven Advantage

Speed of Decision Making

Real-time MRR data enables faster decision making because you're not waiting for quarterly reports or annual industry analyses. You can spot opportunities as they emerge and respond to competitive threats before they become serious problems.

This speed advantage compounds over time as you make better decisions faster than competitors who are still relying on outdated information.

Resource Allocation Optimization

Performance data helps you allocate resources more effectively. You can identify which market segments are growing, which customer acquisition channels are working, and which product features are driving retention. This optimization helps you achieve better results with the same resources.

Risk Mitigation

Real-time competitive intelligence helps you identify risks before they become problems. You can spot new competitors entering your market, identify companies that might be acquisition targets for larger competitors, and recognize market trends that might affect your business.

This risk awareness helps you make proactive adjustments to your strategy rather than reactive responses to market changes.

The Future of SaaS Competitive Intelligence

Beyond Individual Company Analysis

The future of competitive intelligence isn't about analyzing individual companies—it's about understanding market ecosystems. This means tracking performance across entire categories, identifying convergence patterns, and spotting opportunities that emerge from the intersection of different markets.

Zeltadata's category-based approach represents this evolution. Instead of researching companies one by one, you can analyze entire market segments to identify patterns and opportunities.

Real-Time Market Dynamics

The SaaS landscape changes too quickly for quarterly market research. The companies that succeed in the next decade will be those that can track market dynamics in real-time and adjust their strategies accordingly.

This requires tools that can monitor performance across thousands of companies simultaneously and identify patterns that indicate market shifts before they become obvious.

Predictive Market Intelligence

The next evolution of competitive intelligence will be predictive—identifying which companies are likely to succeed, which markets are about to explode, and which trends are worth following. This requires sophisticated analysis of performance patterns, market conditions, and business model innovations.

Getting Started with Real-Time SaaS Intelligence

Immediate Action Steps

The most successful founders don't wait for perfect information—they start with the best available data and improve their intelligence systems over time. Here's how to get started:

Set Up Category Monitoring: Identify the 3-5 most important categories for your business and set up systematic monitoring of performance trends, new entrants, and market dynamics.

Establish Performance Benchmarks: Use real-time MRR data to establish baseline performance metrics for your category. This helps you understand whether your growth is competitive and identify areas for improvement.

Create Alert Systems: Set up alerts for significant performance changes among competitors, new companies entering your space, and market trends that might affect your business.

Building Intelligence Into Your Strategy

Real-time competitive intelligence should inform every major strategic decision. Product development priorities, pricing strategies, market entry decisions, and partnership opportunities should all be based on actual performance data rather than assumptions.

This means building intelligence gathering into your regular business processes rather than treating it as a separate research activity.

The Compound Benefits

Companies that implement systematic competitive intelligence gain advantages that compound over time. They make better strategic decisions, identify opportunities faster, and avoid competitive threats more effectively.

This compound advantage is why the most successful SaaS companies invest heavily in market intelligence and competitive analysis.

Your Competitive Intelligence Advantage

The SaaS companies that dominate the next decade won't be those with the best products—they'll be those with the best market intelligence. They'll spot opportunities before they become obvious, understand competitive dynamics before they become problems, and make strategic decisions based on real data rather than guesswork.

Traditional competitive research is too slow and too limited for today's dynamic SaaS landscape. The founders who are building category-defining companies are already using real-time performance data to guide their strategic decisions.

Real-time MRR data isn't just about tracking competitors—it's about understanding market dynamics, identifying opportunities, and making strategic decisions with confidence. The companies that master this approach will capture market share while their competitors are still trying to figure out what's happening.

Your next strategic advantage isn't hiding in some secret market research report. It's right there in the real-time performance data that reveals which companies are actually growing, which business models are working, and which opportunities are emerging.

The question isn't whether real-time competitive intelligence provides an advantage—it's whether you'll implement it before your competitors do. The companies that move first will capture the opportunities that others miss.

Ready to stop guessing and start knowing? Zeltadata provides the real-time MRR data and category intelligence you need to make strategic decisions with confidence. Explore thousands of SaaS companies, track real-time performance metrics, and discover the insights that will drive your next strategic move.

The future belongs to founders who can see what's actually happening in their markets. That advantage starts with having the right data at your fingertips.

.webp)