AI vs. Traditional SaaS: Where to Invest Your Time & Money in 2025

The SaaS landscape has never been more polarized. On one side, traditional software companies are doubling down on proven models—CRM systems, project management tools, and HR platforms that have generated billions in revenue. On the other, AI-powered startups are raising massive rounds and promising to automate everything from customer service to code generation.

For founders in 2025, the question isn't whether AI will impact software—it's which category deserves your investment, attention, and precious development resources. The answer requires cutting through the hype and examining real market data, growth trajectories, and competitive dynamics.

The Current State of AI SaaS vs Traditional Software

Traditional SaaS companies built their moats through years of feature development, customer relationships, and operational efficiency. They've mastered the fundamentals: predictable revenue models, low churn rates, and scalable customer acquisition. Companies like Salesforce, HubSpot, and Slack represent the gold standard of software businesses—boring, profitable, and defensible.

AI SaaS tools, meanwhile, are experiencing explosive growth in specific verticals. Customer service automation, content generation, and data analysis tools are seeing adoption rates that would make any traditional SaaS founder jealous. But beneath the surface, many AI companies struggle with unit economics, customer retention, and the constant pressure to justify their AI capabilities.

The market is sending mixed signals. While venture capital pours into AI startups, many traditional SaaS companies are quietly integrating AI features and maintaining their competitive advantages. The question for founders becomes: Are you building in a category that's being disrupted, or are you the disruptor?

Growth Metrics: What the Numbers Actually Show

Let's examine the real performance data between AI and traditional SaaS companies across key metrics that matter to founders.

The data reveals a nuanced picture. AI SaaS companies are growing faster but burning more cash to acquire customers. Traditional SaaS maintains better unit economics and customer retention, but growth rates are more conservative.

What's particularly interesting is the variance within each category. The fastest growing AI tools are concentrated in content creation, sales automation, and developer productivity. Traditional SaaS winners are dominating in industries where switching costs are high: financial services, healthcare, and enterprise workflow management.

Market Opportunities: Where the Real Money Is

The most successful founders in 2025 aren't choosing between AI and traditional SaaS—they're identifying where AI creates genuine value versus where traditional approaches still reign supreme.

High-Opportunity AI Categories:

Content and creative tools are experiencing unprecedented demand. Companies building AI-powered writing assistants, image generators, and video editing tools are seeing monthly growth rates exceeding 30%. The key differentiator isn't just AI capability—it's workflow integration and output quality that matches or exceeds human performance.

Developer productivity tools represent another goldmine. AI-powered code completion, debugging assistants, and automated testing tools are becoming essential infrastructure for software teams. These tools solve real problems with measurable ROI, making customer acquisition and retention more predictable.

Customer service automation has matured beyond simple chatbots. AI tools that can handle complex customer inquiries, integrate with existing support systems, and provide actionable insights are commanding premium pricing and low churn rates.

Thriving Traditional SaaS Niches:

Financial management and accounting software continues to dominate despite AI advancements. The combination of regulatory requirements, data sensitivity, and established workflows makes this category resistant to disruption. Traditional SaaS companies in fintech are growing steadily with excellent unit economics.

Industry-specific workflow tools remain highly defensible. Healthcare practice management, legal case management, and construction project tracking require deep domain expertise that AI hasn't replicated. These vertical SaaS companies maintain pricing power and customer loyalty.

Collaboration and communication platforms are evolving rather than being replaced. While AI features are being added, the core value proposition remains human-to-human interaction and workflow coordination.

Investment Patterns and Market Validation

Venture capital allocation reveals where smart money is betting. In 2024, AI SaaS companies raised an average of $2.3 million in seed rounds compared to $1.8 million for traditional SaaS. But the follow-on funding patterns tell a different story.

AI companies that successfully raise Series A demonstrate stronger product-market fit metrics and clearer paths to profitability. The market is becoming more discerning about AI capabilities versus AI marketing. Investors are looking for defensible AI moats, not just AI features.

Traditional SaaS companies are raising smaller rounds but achieving profitability faster. The path to sustainable growth is well-established, making them attractive to investors focused on capital efficiency and predictable returns.

Competitive Landscape Analysis

Understanding your competitive environment is crucial for resource allocation decisions. AI SaaS markets are becoming increasingly crowded, with new tools launching daily. Differentiation requires more than AI capabilities—it demands superior user experience, integration capabilities, and clear value propositions.

Traditional SaaS markets appear saturated but offer opportunities for focused execution. Winning requires operational excellence, customer success programs, and incremental innovation rather than breakthrough technology.

The most dangerous assumption founders make is that AI automatically creates competitive advantages. Many AI features are becoming commoditized through API access and open-source models. The real moat comes from data, distribution, and domain expertise.

Making the Right Choice for Your Startup

For founders evaluating where to invest their time and money, the decision framework should prioritize market timing, competitive dynamics, and your team's strengths over technology trends.

Choose AI SaaS when:

- You're solving a problem that humans struggle with at scale

- Your team has deep AI/ML expertise

- You can demonstrate measurable performance improvements

- The market is willing to pay premium pricing for AI capabilities

- You have a clear path to defensible data advantages

Choose Traditional SaaS when:

- You're entering a proven market with established demand

- Your competitive advantage comes from execution, not technology

- Customer switching costs and network effects are important

- You need predictable unit economics and faster path to profitability

- Regulatory or compliance requirements favor traditional approaches

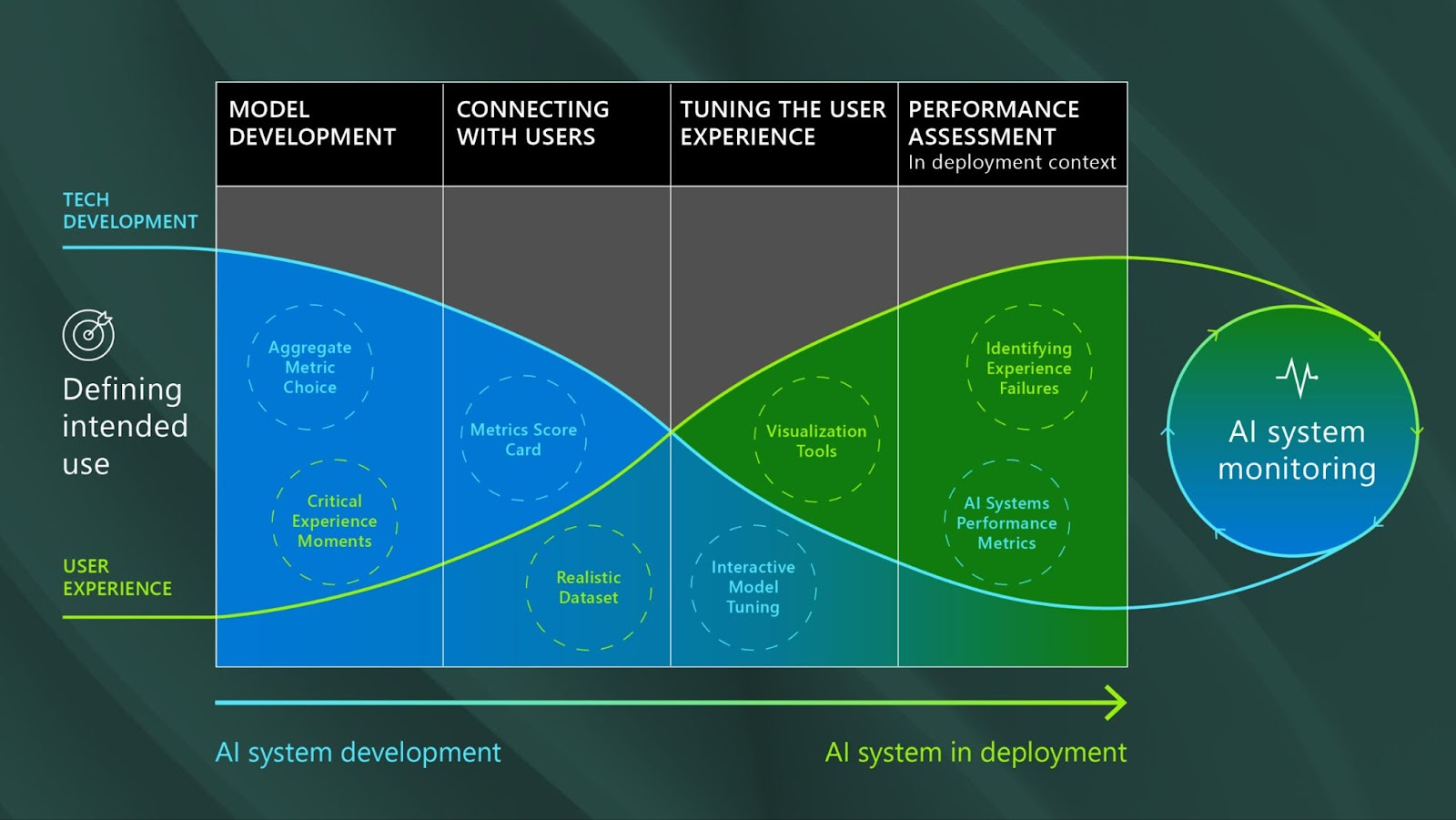

Tools for Making Data-Driven Decisions

Making informed investment decisions requires access to real-time market data and competitive intelligence. While many founders rely on generic research tools like Similarweb or Crunchbase, these platforms weren't designed for the specific needs of SaaS entrepreneurs.

This is where specialized tools like Zeltadata become invaluable for founders navigating the AI versus traditional SaaS decision. Unlike broad market research platforms, Zeltadata functions as an AI-powered market radar specifically designed for SaaS founders who need to understand what's growing and what's not in real-time.

The platform allows founders to explore thousands of SaaS and AI SaaS companies through filtered categories, view real-time financial dashboards showing MRR, ARR, and churn rates, and discover trending companies in any niche. Whether you're evaluating "Fintech AI" opportunities or traditional "Marketing Tools" markets, Zeltadata provides the focused market intelligence that generic tools miss.

For founders deciding between AI and traditional SaaS investments, this type of category-specific trend analysis and real-time performance data eliminates the guesswork. Instead of spending weeks researching individual companies, you can quickly identify which categories are experiencing genuine growth versus hype-driven investment.

The Future Landscape

The AI versus traditional SaaS debate will likely resolve into a hybrid model where successful companies combine the best of both approaches. AI will enhance traditional software capabilities while proven SaaS business models will stabilize AI-powered tools.

The winners will be founders who focus on solving real problems for paying customers rather than following technology trends. Whether you choose AI or traditional SaaS matters less than your ability to execute, acquire customers, and build sustainable businesses.

Market conditions in 2025 favor founders who can demonstrate clear value propositions, efficient customer acquisition, and paths to profitability. The most important investment you can make is in understanding your market, customers, and competition better than anyone else.

Ready to make data-driven decisions about your next SaaS investment? Explore Zeltadata's AI-powered market radar to discover trending opportunities, analyze competitor performance, and validate your market assumptions with real-time SaaS data. Start your market research today and invest your time and money where the growth actually is.

.webp)